On March 28, 2023, Deputy Prime Minister and Minister of Finance Chrystia Freeland released Canada’s 2023 Budget (Budget 2023).

Budget 2023 prioritizes four key initiatives: (i) strengthening the middle class, (ii) making life more affordable, (iii) increasing accessibility to public health, and (iv) fostering a more environmentally sustainable economy.

From a tax perspective, Budget 2023 revealed a continued effort to fine-tune and implement previously announced measures. While there were no business or personal income tax rate increases, clean energy continues to be the focus and there is a clear directive to combat abusive tax avoidance schemes both domestically and internationally. Further, the proposed changes focus on supporting the middle class through inflationary times, namely by ensuring that the wealthiest Canadians pay their fair share of taxes.

This tax alert summarizes the personal and business income tax measures as well as indirect tax measures in Budget 2023 relevant to the middle market.

Personal tax measures

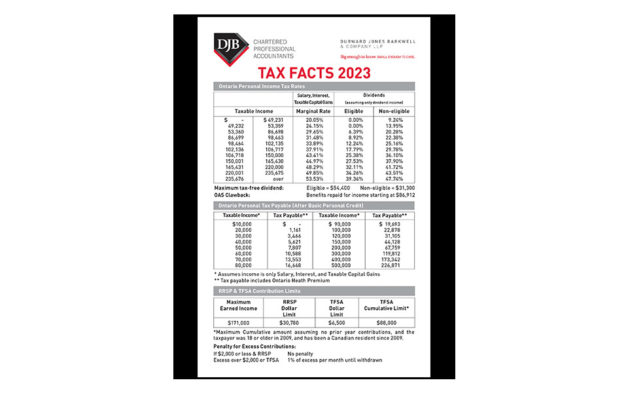

Budget 2023 proposes no changes to personal tax rates.

Employee ownership trusts

Employee ownership trusts (EOTs) were proposed as part of Budget 2022 as a vehicle to facilitate the purchase of a business by its employees without requiring them to pay directly to acquire shares of the business. EOTs will provide a valuable option for Canadian business owners interested in succession planning. These proposed changes will come into effect as of January 1, 2024.

The rules proposed in Budget 2023 on EOTs provide qualifying conditions to establish an EOT and changes to existing rules in the Income Tax Act (ITA).

Budget 2023 proposes that an EOT must have only two purposes:

- To hold shares of a qualifying business for the benefit of employees; and,

- To make distributions to those employee beneficiaries based on a legislative formula.

An EOT would be required to hold a controlling interest in the shares of one or more qualifying businesses. All or substantially all of an EOT’s assets must also be shares of a qualifying business.

Budget 2023 also updates existing rules in the ITA to better accommodate the establishment and use of EOTs. This includes increasing the deferral of capital gains for the sale of a business to an EOT for up to ten years, providing for a minimum 10% annual taxable inclusion of the gain. Ordinarily, a deferral of the recognition of a capital gain is allowed for a maximum of five years, providing for a minimum 20% annual taxable inclusion of the gain.

Further, an EOT will be exempted from existing rules in the ITA that require an employee to include a loan from a business in their income if that loan is not repaid within one year. Instead, a corporation would be entitled to loan amounts to an EOT for up to fifteen years without income recognition at the employee level. Additionally, EOTs are exempt from the 21-year rule, which generally requires certain trusts to be deemed to have disposed of their property every 21 years.

Application to mergers and acquisitions (M&A)

The EOT proposals would be welcome news to many private Canadian business owners who wish to transition their businesses to employees on a tax-efficient basis. The proposed EOT framework addresses many of the historical challenges associated with transitioning a business to employees, including tax-efficient financing, managing the timing of cash flows to taxation, and permitting access to capital gains treatment.

Strengthening the intergenerational business transfer framework

Bill C-208 was intended to facilitate genuine intergenerational business transfers by providing an exception to the anti-surplus stripping rules contained in the ITA. However, after the bill received royal assent on June 29, 2021, the federal government realized that it permitted surplus-stripping transactions to occur where no legitimate transfer of a business to the next generation took place.

Budget 2023 proposes to amend the rules introduced by Bill C-208 to ensure that they apply only where a genuine intergenerational business transfer takes place, effective January 1, 2024.

A genuine intergenerational share transfer would be a transfer of shares of a corporation by a natural person to another corporation where a number of conditions are satisfied. For instance, each share transferred must be either a “qualified small business corporation share” or a “share of a family farm or fishing corporation” at the time of transfer. Further, taxpayers who wish to undertake a genuine intergenerational share transfer must rely on one of two transfer options:

- An immediate intergenerational business transfer (a three-year test); or,

- A gradual intergenerational business transfer (a five-to-ten-year test).

The immediate intergenerational business transfer approach would provide finality earlier in the process but with more stringent conditions. Both legal and factual control of a business must be immediately transferred to the next generation.

The gradual intergenerational business transfer approach would require the initial transfer of only legal control.

Both types of transfers have detailed nuances to account for. Regardless of the intergenerational transfer approach taken, both options are eligible for a graduated ten-year reserve on capital gains incurred on the transfer.

Application to M&A

Owner-managers looking to transition their business should consider either the immediate business transfer route or the gradual business transfer. The choice should be based on the complexity and the readiness of the next generation acquiring the business, so as to structure the transition to meet the above conditions. Notably, while the gradual business transfer has seemingly eased restrictions, having to meet certain those conditions for up to 13 years post-transfer can be difficult and could result in a reassessment back to the initial year of transfer.

Alternative minimum tax for high-income individuals

The Alternative Minimum Tax (AMT) is a parallel tax calculation that allows fewer deductions and tax credits than the usual progressive rate calculation. An individual pays the higher of the AMT and the regular progressive rate calculation. Proposed changes include broadening the AMT base, raising the AMT exemption, and increasing the AMT rate. The changes are intended to be effective for taxation years that begin after 2023.

The AMT base would be broadened by increasing the following inclusion rates:

- Ordinary capital gains from 80% to 100%;

- Employee stock option benefits from 0% to 100%; and,

- Capital gains on donations of publicly listed securities to 30%

The AMT base would also be broadened by disallowing 50% of certain deductions, such as employment expenses, moving expenses, child-care expenses, limited partnership losses of other years, and noncapital loss carryovers. Additionally, only 50% of nonrefundable tax credits would be allowed to reduce the AMT base, subject to certain exceptions.

Lastly, Budget 2023 proposes increasing the AMT rate from 15% to 20.5% and raising the AMT exemption from $40,000 to the start of the fourth federal tax bracket, currently estimated to be approximately $173,000 for 2024. This means that the basic AMT exemption will be indexed annually.

Application to M&A

Taxpayers should consider the impact of the revisions proposed by Budget 2023 in the context of a liquidity event where tax attributes are being utilized to reduce or eliminate an individual’s tax liability. Additionally, consideration should be given where that individual is not expected to have sufficient income to recover any AMT paid in the near future. The increase in the overall rate coupled with no changes to the carryforward period may result in a greater amount of AMT becoming in effect a permanent tax.

The higher inclusion rate for general capital gains realized in the year of a transaction may increase the AMT for high-income individuals under the revised formula. Taxpayers would be prudent to model the estimated impact of these adjustments on expected transactions for taxation years starting after 2023 and consider accelerating transactions where it is advantageous to do so.

Business tax measures

Budget 2023 proposes no changes to the federal corporate income tax rates or the $500,000 small business limit.

Changes to the general anti-avoidance rules (GAAR)

Budget 2023 proposes to amend the GAAR in multiple ways, namely:

- By introducing a preamble;

- Changing the avoidance transaction standard;

- Introducing an economic substance rule;

- Introducing a penalty; and,

- Extending the reassessment period in certain circumstances.

The preamble would clarify the scope of the GAAR in its application with the intention for it to apply to every other provision of the ITA. The avoidance transaction standard is proposed to narrow from a “primary purpose” test to a “one of the main purposes” test. Additionally, the proposed amendments would provide that economic substance is to be considered at the “misuse or abuse” stage of the GAAR analysis and that a lack of economic substance tends to indicate abusive tax avoidance. These indicators of a lack of economic substance, while not intending to be exhaustive, may include:

- Whether there is a potential for pre-tax profit;

- Whether the transaction has resulted in a change of economic position; or,

- Whether the transaction is entirely (or almost entirely) tax-motivated.

A penalty of 25% will also be introduced on the tax benefit if the transaction is subject to the GAAR. The penalty could be avoided if the taxpayer disclosed the transaction to the CRA voluntarily or under the mandatory disclosure rules. Budget 2023 also expands the normal reassessment period by three years for reassessments made under GAAR unless the transaction was already disclosed to the CRA.

Application to M&A

If enacted as proposed, commonplace M&A tax planning may fall within the expanded scope of the GAAR. In that instance, taxpayers should consider potential impacts on their acquisition or divestiture structures that may be caught by the revised GAAR. Taxpayers would also have to ensure that adequate documentation is maintained with respect to commercial considerations supporting the planning steps undertaken in order to meet the economic substance requirement under the proposed rules. The expansion of the GAAR will also be relevant to buyers as they seek to understand potential tax exposures, including any extended reassessment periods that may exist in a target company post-acquisition.

Clean hydrogen and technology manufacturing

Budget 2023 proposes to introduce two new environmental measures—the Clean Hydrogen Investment Tax Credit (CHITC) and Clean Technology Manufacturing Investment Tax Credit (CTMITC). Both credits will be subject to new labour requirements, and where a project is eligible for both of these credits, only one can be claimed.

The refundable CHITC will be available to projects that produce all, or substantially all, hydrogen through their production process and in respect of purchasing and installing eligible equipment. The credit will vary between 15% and 40% of the capital cost of eligible property. Those who claim the tax credit will need to meet certain environmental markers over a given period of time to continue to qualify for the credit. This credit will apply to property that is acquired and available for use on or after March 28, 2023, and will be phased out for property that becomes available for use after 2034.

The CTMITC is a refundable credit for clean technology manufacturing and processing, and critical mineral extraction and processing. It will be equal to 30% of the capital cost of eligible property. To qualify for the credit, the eligible property must be utilized in eligible activities, such as the manufacturing of certain renewable energy equipment and the manufacturing of nuclear fuel rods. The credit would apply to property that is acquired and available for use on or after January 1, 2024, and be completely phased out for the property that becomes available for use after 2034. The credit may also be recovered if the eligible property is sold or if there is a change in use.

Tax credit for carbon capture, utilization, and storage

The Investment Tax Credit for Carbon Capture, Utilization, and Storage (CCUS Tax Credit) was originally announced as part of Budget 2022. Following consultations, there are now proposed changes to these rules. In particular, Budget 2023 proposes that:

The credit will apply to dual-use equipment;

- British Columbia be added as an eligible jurisdiction for dedicated geological storage;

- Qualified third parties be permitted to approve the process for using and storing CO2 in concrete instead of requiring approval from Environment and Climate Change Canada; and,

- There be additional rules for the treatment of refurbishment costs and the recovery of refurbishment credits.

Where a project qualifies for this credit and any of the Investment Tax Credit for Clean Technology (CTITC), the Investment Tax Credit for Clean Electricity (CEITC) or the CHITC, the claimant will only be permitted to claim one of these credits. This credit will apply to eligible expenses incurred after 2021 and before 2041.

Share buyback tax

A new tax equal to 2% of the annual net value of repurchased equity is proposed for repurchases and issuances of equity that occur on or after Jan. 1, 2024. This measure will apply to Canadian-resident corporations whose shares are listed on a public stock exchange, real estate investment trusts (REITs), specified investment flow-through (SIFT) trusts, and SIFT partnerships. Mutual fund corporations are excluded. A business would not be subject to the tax if its gross repurchases of equity were less than $1 million during that taxation year. Budget 2023 proposes to also exclude the following transactions from the application of these rules:

- Issuance and cancellation of debt-like preferred shares; and,

- Issuance and cancellation of shares in corporate reorganizations and acquisitions, amalgamations, liquidations, and share-for-share exchanges.

Even though the government hopes this measure will encourage companies to redirect profits to business growth and employees, this tax may have the unintended effect of increasing the cost of capital for public companies. It may also create market inefficiencies, disincentivize private companies from going public and discourage investment in Canadian public companies.

Financial institution dividends

Corporations, including financial institutions, are allowed a dividend-received deduction in respect of dividends received on shares of Canadian resident corporations. Budget 2023 proposes that financial institutions will no longer be able to claim the deduction in respect of dividends received on shares that are mark-to-market property because the deduction conflicts with the policy behind the mark-to-market rules. Under these rules, gains on the disposition of mark-to-market property are included in ordinary income, not capital gains; and unrealized gains are included in computing income annually (in addition to when the property is disposed of). This measure would apply to dividends received after 2023.

Credit unions

For income tax and GST/HST purposes, if a credit union earns more than 10% of its revenue from sources other than certain specified sources (such as revenues from lending activities), it would not meet the definition of a “credit union.” The definition of a credit union is proposed to be amended to remove this revenue test. The proposed amendment would apply to taxation years ending after 2016.

International tax measures

Pillar two – Global minimum tax

Consistent with the announcement in Budget 2022, Budget 2023 announces the federal government’s intention to introduce legislation implementing the Income Inclusion Rule (IIR) and a domestic minimum top-up tax. These rules would be applicable to Canadian entities of multinational enterprises (MNEs), which are within the scope of Pillar Two (MNE with annual revenues of €750 million or more) and the undertaxed profits rule (UTPR).

In general, the IIR would impose a top-up tax on the income of a foreign-controlled entity or a foreign branch if that income was otherwise subject to an effective tax rate that is below 15%. The UTPR is a “backstop” rule that generally applies where neither the ultimate parent jurisdiction nor any intermediate parent jurisdiction of an MNE has implemented the IIR. In these cases, other jurisdictions in which the MNE operates that have implemented the UTPR would impose the top-up tax on the group entities located in their jurisdiction. The top-up tax would be allocated through a formula basis in those jurisdictions.

Budget 2023 proposes to implement the IIR effective for fiscal years of MNEs that begin on or after December 31, 2023, and UTPR for fiscal years of MNEs that begin on or after December 31, 2024.

Previously announced measures

Budget 2022 confirms the government’s intention to proceed with the following international tax measures previously announced:

- Legislative proposals released on November 3, 2022, with respect to Excessive Interest and Financing Expenses Limitations.

- Legislative proposals released on April 29, 2022, with respect to Hybrid Mismatch Arrangements.

Transfer pricing (TP) measures

The transfer pricing consultation paper is still forthcoming

Budget 2023 confirms the government’s intention to proceed with the Transfer Pricing Consultation paper previously announced in Budget 2021. While the Transfer Pricing Consultation contents remain unknown, initial indications of its focus exist in the proposed GAAR amendments on economic substance.

Following prominent global guidance, the CRA auditors have more recently audited with economic substance in mind. This is generally inconsistent with Canadian law, which has predominantly focused on legal form. As a result of this and other factors, the Department of Finance has experienced adverse outcomes for prominent transfer pricing court cases.

It is possible that these amendments may serve as a precursor to the CRA adopting a more substance-over-form approach, which may be central to the forthcoming Transfer Pricing Consultation. This can only be confirmed once the Consultation paper is released to evaluate the potential implications of the amendment.

Adoption of pillar one – Reallocation of taxing rights

Budget 2023 confirms the intention to adopt Pillar One. Pillar One will reallocate taxing rights over the profits of the largest and most profitable multinational enterprises (MNEs) to align with the jurisdictions of their users and customers. Budget 2023 indicates Pillar One has an anticipated entry-to-force date during 2024.

To the extent Pillar One is not adopted by January 1, 2024, the previously announced Digital Services Tax (DST) will enter force in respect of revenues earned as of January 1, 2022.

Indirect tax measures

The grocery rebate

Budget 2023 introduces the Grocery Rebate, which will increase the maximum goods and services tax credit (GSTC) for January 2023 by twice the amount received for January 2023. This would result in an effectual tripling of what would have otherwise been received for the month of January 2023 for eligible GSTC recipients. The Grocery Rebate will be paid as soon as related legislation is passed through the GSTC system. Maximum amounts under the Grocery Rebate will be $153 per adult, $81 per child, and $81 for the additional single supplement.

GST/HST treatment of payment card clearing services

Budget 2023 proposes to exclude payment card clearing services rendered by a payment card network operator from the GST/HST definition of “financial service”. Under the Excise Tax Act, supplies of financial services are generally “exempt” for GST/HST purposes. This amendment follows a recent court decision that found that the GST/HST does not apply to supplies of these services. As such, the amendment ensures that such services will generally continue to be subject to the GST/HST.

This measure will apply to a service rendered under an agreement for a supply if any consideration for the supply becomes due or is paid without becoming due after March 28, 2023. If the consideration for the supply became due or was paid on or before March 28, 2023, the measure will only not apply if the supplier did not charge, collect or remit any amount of GST/HST in respect of the supply. The measure will also not apply in respect of any other supply that is made under the agreement and that includes the provision of a payment card clearing service.

Cannabis taxation – Quarterly duty remittances

The excise duty on cannabis products is typically remitted on a monthly basis. However, previous changes introduced by the 2022 budget allowed smaller-licensed businesses to remit their excise duties quarterly. Budget 2023 proposes that starting April 1, 2023, all licensed cannabis producers will be permitted to remit excise duties quarterly.

Credits and incentives measures

Clean technology and innovation

These programs provide funding for large projects across sectors that include emissions reduction, biomanufacturing, and natural resources. Over the next 10 years, over $500 million will be allocated to support the development and application of clean technologies, critical minerals, and industrial transformation.

Canada innovation corporation

Budget 2023 proposes new measures to encourage business innovation by spurring business and research development through the creation of the new Canada Innovation Corporation (CIC) for both new and established industries. The CIC is a new Crown corporation with a mandate to increase Canadian business expenditure on research and development across all sectors and regions of Canada.

Student placement programs

Budget 2023 continues to support Canada’s student work placement programs by providing employers with subsidies to promote the hiring of students to gain experience in the workforce. The program proposes to provide $197.7 million in 2024-25 to continue creating quality work-integrated learning opportunities for students through partnerships between employers and post-secondary education institutions.

Scientific research and experimental development

Budget 2023 does not propose any change regarding the Scientific Research and Experimental Development (SR&ED) tax incentive program. However, in 2022, the federal government announced intentions to review the SR&ED program to safeguard and encourage research and development that benefits Canada as well as to investigate opportunities for modernization and simplification of the program, such as changes to eligibility criteria. In the coming months, the Department of Finance will continue to engage with stakeholders to ensure the SR&ED program is effectively supporting the development of intellectual property.

Audit and enforcement measures

Publicly accessible federal beneficial ownership registry

As part of the government’s commitment to corporate transparency, Budget 2023 proposes further amendments to the Canada Business Corporations Act, the Proceeds of Crime (Money Laundering) and Terrorist Financing Act, the ITA, and other statutes to implement a publicly accessible beneficial ownership registry. These amendments are in addition to the ones already implemented under the 2022 budget.

The changes will:

- Introduce protections for whistleblowers;

- Bolster the powers of Corporations Canada to make inquiries;

- Introduce an exemption regime for certain individuals who may face harm from public disclosure, including minors;

- Ensure compliance with the new regime through robust criminal and monetary penalties; and,

- Facilitate information-sharing and data validation, including investigative bodies and the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC).

Automatic tax filing

To allow low-income Canadians to access valuable support, Budget 2023 provides that the federal government will increase the number of eligible Canadians for File My Return to two million by 2025. File My Return is a service that allows eligible simple tax-filing Canadians to auto-file their tax return over the phone after answering a series of short questions. Additionally, the CRA is piloting a new automatic tax filing service to assist vulnerable Canadians who do not file their taxes to receive their benefits starting in 2024.

COVID benefits

To ensure the integrity of Canada’s emergency benefit system post-COVID-19, Budget 2023 proposes to provide $53.8 million in 2022-23 to Employment and Social Development Canada to support integrity activities relating to overpayments of COVID-19 emergency income supports.

Source: RSM Canada

Used with permission as a member of RSM Canada Alliance

https://rsmcanada.com/insights/budget-commentary/2023-canada-federal-budget-detailed-commentary.html

The information contained herein is general in nature and based on authorities that are subject to change. RSM Canada guarantees neither the accuracy nor completeness of any information and is not responsible for any errors or omissions, or for results obtained by others as a result of reliance upon such information. RSM Canada assumes no obligation to inform the reader of any changes in tax laws or other factors that could affect information contained herein. This publication does not, and is not intended to, provide legal, tax or accounting advice, and readers should consult their tax advisors concerning the application of tax laws to their particular situations. This analysis is not tax advice and is not intended or written to be used, and cannot be used, for purposes of avoiding tax penalties that may be imposed on any taxpayer.

RSM Canada Alliance provides its members with access to resources of RSM Canada Operations ULC, RSM Canada LLP and certain of their affiliates (“RSM Canada”). RSM Canada Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each are separate and independent from RSM Canada. RSM Canada LLP is the Canadian member firm of RSM International, a global network of independent audit, tax and consulting firms. Members of RSM Canada Alliance have access to RSM International resources through RSM Canada but are not member firms of RSM International. Visit rsmcanada.com/aboutus for more information regarding RSM Canada and RSM International. The RSM trademark is used under license by RSM Canada. RSM Canada Alliance products and services are proprietary to RSM Canada.

|

DJB is a proud member of RSM Canada Alliance, a premier affiliation of independent accounting and consulting firms across North America. RSM Canada Alliance provides our firm with access to resources of RSM, the leading provider of audit, tax and consulting services focused on the middle market. RSM Canada LLP is a licensed CPA firm and the Canadian member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries. Our membership in RSM Canada Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise, and technical resources. For more information on how DJB can assist you, please contact us. |