|

Create a budget and include lump sum items such as vacations and gifts. Ensure you allocate funds to savings because there is no such thing as “extra” money.

Helpful Tips to Create a Budget

|

|

|

Top up RRSP for the previous year. You can make a contribution for the previous year any time during the first 60 days of the next year. If you’re turning 71 this year you’ll need to make your RRSP contribution prior to converting your RRSP to a RRIF, December 31 at the latest.

Considerations for Using a Spousal RRSP

|

|

|

Collect information required for your accountant to file your tax returns on time. The tax filing deadline for individuals in Canada is April 30th each year. If you file a US tax return, the deadline is April 15 and if you administer a Trust, you have until March 31 to file its return.

|

|

|

If you haven’t already, start monthly contributions to match your budget goals. You can allocate monthly contributions to TFSA, RRSP, or non-registered investments based on your budget and goals.

|

|

|

Contribute to your child’s Registered Education Savings Plan. Ensure you are receiving the maximum matching grants and bonds from the government to help build the savings for your child’s post-secondary education. You can double up your contributions if you have previous year’s unused contribution room.

WITHDRAWING FROM FAMILY RESPs: Flexible Planning Possibilities Registered Education Savings Plans (RESP) Benefit Information

|

|

|

Review your employee benefits and pension to ensure you are getting the most value for your money. Determine what benefits you are entitled to and ensure you are using them if needed. When it comes to matching pension or group RRSP contributions from your employer, ensure you are receiving the maximum from your employer.

EMPLOYEE GIFTS AND PARKING: Updated CRA Policies

|

|

|

Review your life and disability insurance to ensure adequate coverage to protect you, your loved ones, and your lifestyle.

Review your life and disability insurance to ensure adequate coverage to protect you, your loved ones, and your lifestyle. Life Insurance: Do I Really Need it?

|

|

|

Review your Wills and Powers of Attorney and update if necessary. This is also a good time to review the beneficiary designations in your TFSA, RRSP’s, employee benefits & pension and your life and disability insurance to ensure they are aligned with your estate planning.

|

|

|

Review your non-registered investment portfolio and identify gains and losses generated in the current year. Strategize with your accountant and investment professional to put yourself in the best position come tax time.

|

|

|

Consider donating to your favourite church or charity. There are many worthwhile causes looking for your hard-earned savings. Have a plan for which organizations you would like to support. You can donate cash, investments, and perhaps even your time.

|

|

|

Review your financial and estate planning and modify if necessary. This is your personal roadmap to reach the goals that you set for yourself. Hold yourself accountable to it, but also be flexible when necessary. Your financial planning should consolidate the planning you are doing in the other eleven months of the year into a single working document. Consider measuring your achievement towards your goals by updating your net worth each year.

The Importance of Having a Comprehensive Financial Plan

|

|

|

Ensure you have a plan to repay your debts. Set a “Debt Free” date and works towards achieving it. Keep in mind that with inflation on the rise, interest rates will be soon to follow.

|

|

| Click here for a printable version. | ||

Category: Financial Planning & Wealth Management

The Tax Free Savings Account

In 2009, the federal government introduced the Tax Free Savings Account (TFSA) to give Canadians another means to save for their financial goals. The TFSA is similar to the Registered Retirement Savings Plan (RRSP) in some ways, but different in others.

TFSA Quick facts:

- Investments grow and compound on a completely tax-free basis within the TFSA.

- Contributions to the TFSA are not tax-deductible, but withdrawals are tax-free and can be made at any time.

- Unused contribution amounts accrue and can be used in future years.

- The current annual contribution limit is $7,000 per person, increasing in $500 increments based on inflation.

- Anyone who was 18 years of age in 2009 and resident in Canada during the period between 2009-2024 and has never contributed to a TFSA has a contribution limit of $95,000.

- Withdrawals from the TFSA do not impact Old Age Security (OAS) benefits.

Things to consider when deciding to use a TFSA:

- Consider how the TFSA fits within your overall financial plan –it may be better to maximize RRSPs, RESPs, or pay down personal debt first.

- The TFSA can complement other retirement savings and since withdrawals are tax-free, they could help you avoid potential Old Age Security (OAS) claw-back.

- Since contributions can be made at any age over 18, a TFSA can be a powerful estate planning tool in building a sizable tax-free asset for an estate or heirs – a benefit similar to using permanent life insurance. If a specific beneficiary is named in a TFSA, the estate administration tax (probate fees) can be avoided on the value of the plan.

- Consider using existing personal non-registered savings to maximize TFSA contribution limits in order to shelter future investment income from tax.

- Investors owning a corporation may want to consider withdrawing additional dividends to fund a TFSA. Although the additional income from the corporation would be taxable, future investment earnings on those contributions would be tax-free.

- Both capital and growth can be withdrawn on a tax-free basis. The total amount withdrawn can then be re-contributed in the next calendar year, or any time afterwards, with no impact on annual contribution limits.

A DJB Wealth Management Advisor can help you make the right choice.

Inflation, Interest Rates Will Have a Surprising Effect on Your Taxes Next Year

The Bank of Canada’s decision this week to hold its benchmark interest rate steady at 5% as it attempts to battle inflation was welcome news for many. But the effects of both higher interest rates and inflation on the tax system will be felt in the new year in at least a couple of ways based on recent economic data available over the past week or so.

First, let’s start with the interest rate environment. It appears that even though the central bank’s rate isn’t rising, the Canada Revenue Agency’s prescribed interest rate will indeed increase (yet again) as of Jan. 1, 2024. The prescribed rate is set quarterly and is tied directly to the yield on Government of Canada three-month Treasury bills, but with a lag.

The calculation is based on a formula in the Income Tax Regulations that takes the simple average of three-month Treasury bills for the first month of the preceding quarter, rounded up to the next highest whole percentage point (if not already a whole number).

To calculate the rate for the upcoming quarter (Jan. 1 through March 31, 2024), we look at the first month of the current quarter (October 2023) and take the average of the three-month T-bill yields, which were 5.16% (Oct. 10) and also 5.16% (Oct. 24). Since the prescribed rate is then rounded up to the nearest whole percentage point, we get 6% for the new prescribed rate for the first quarter of 2024. Contrast this with the historically low rate of 1% we had from July 1, 2020, through June 30, 2022. The last time the prescribed rate was 6% was more than 20 years ago in the second quarter of 2001.

The hike in the prescribed rate has a number of implications. To understand these, we should point out that there are, in reality, three prescribed rates: the base rate, the rate paid for tax refunds, and the rate charged for unpaid taxes. The base rate, which will be increasing to 6% (from 5%) on Jan. 1, applies to taxable benefits for employees and shareholders, low-interest loans, and other related party transactions.

The rate for tax refunds is two percentage points higher than the base rate, meaning that if the CRA owes you money, the rate of interest will be 8% as of Jan. 1. Note, however, that rushing to file your 2023 tax return as early as possible next tax filing season won’t necessarily get you that rate on your refund, because the CRA only pays refund interest on amounts it owes you after May 30, assuming you filed by the deadline.

Finally, if you owe the CRA money, or if you’re late or deficient in one of your quarterly tax instalments, then the rate the CRA charges is a full four percentage points higher than the base rate. This puts the interest rate on tax debts, penalties, insufficient instalments, unpaid income tax, Canada Pension Plan contributions, and employment insurance premiums at a whopping 10% come Jan. 1.

Keep in mind that this interest is compounded daily and is not tax deductible. For example, if you’re a resident of Newfoundland and Labrador and in the highest 2023 tax bracket of 55%, that means you’d have to find an investment that earns a guaranteed, pre-tax rate of return of 22% to be better off than paying down your tax debt.

The other recent economic news that will impact taxpayers in 2024 is the latest inflation number. The tax brackets and most other amounts in the tax system are indexed to inflation. While the inflation indexation factor for 2024 that will be applied to the tax brackets and various other amounts won’t officially be released by the CRA until November, we can do a rough calculation based on the consumer price index (CPI) data released by Statistics Canada last week.

The federal indexation factor for 2024 is calculated as the average of the monthly CPI numbers for the 12-month period ended Sept. 30, 2023, divided by the average of the monthly CPI factors for the 12-month period ended Sept. 30, 2022. The September CPI data released last week showed a 3.8% increase over the past 12 months. We can then use this data to finalize the 2024 indexation factor, which should come in at 4.7%. By comparison, the 2023 indexation factor was 6.3%.

The silver lining in the latest inflationary number is that the tax-free savings account (TFSA) limit for 2024 should go up to $7,000, an increase from the current 2023 limit of $6,500. Note that this marks the first time the TFSA limit has risen in two consecutive years, as it was $6,000 in 2022.

The TFSA was first introduced in the 2008 federal budget and became available to Canadians for the 2009 calendar year. Its initial limit of $5,000 rose to $5,500 and stayed there for a number of years, with a short-lived flirtation at $10,000 in 2015. Under the tax rules, starting in 2016 and for each subsequent year, the annual TFSA dollar limit was fixed at $5,000, indexed to inflation for each year after 2009, and rounded to the nearest $500, which makes the annual limits easy to remember.

The TFSA limit only gets increased, therefore, when the cumulative effect of the annual inflation adjustments is enough to push the limit to the next highest $500 increment. The indexed TFSA dollar amount for 2024 is now at $6,859, meaning that the official limit gets boosted to $7,000, the closest $500 increment.

For someone who has never contributed to a TFSA and has been a resident of Canada and at least 18 years of age since 2009, the total contribution room available in 2024 will rise to $95,000 from $88,000 in 2023.

WITHDRAWING FROM FAMILY RESPs: Flexible Planning Possibilities

A July 21, 2021, Money Sense article (My three kids chose different educational paths. How do I withdraw RESP funds in a way that’s fair to them and avoids unnecessary taxes?, Allan Norman) considered some possibilities and strategies to discuss when withdrawing funds from a single RESP when children have different financial needs for their education.

Some of the key points included the following:

- There is likely a minimum educational assistance payment (EAP) withdrawal that should be taken, even by the child that needs it least.

- The EAP includes government grants (up to $7,200) and accumulated investment earnings on both the grants and taxpayer contributions.

- The grants can be shared, but only up to $7,200 can be received per child, with unused amounts required to be returned to the government.

- Only $8,000 ($5,000 in previous years) in EAPs can be withdrawn in the first 13 weeks of consecutive enrollment.

- The withdrawal amount is not restricted by school costs. • The children are taxed on EAP withdrawals.

- It is generally best to start withdrawing the EAP amounts as early in the child’s enrollment as possible, when the child’s taxable income is lowest. If the child is expected to experience lower income in later years, there is flexibility to withdraw EAP amounts in those later years instead.

- The level of EAP withdrawn for each child can be adjusted. As individuals are taxed on the EAP withdrawals, planning should consider the children’s other expected income (e.g. targeting less EAPs for years in which they will be working, perhaps due to co-op programs or graduation). Consider having the EAP completely withdrawn before the year of the last spring semester as the child will likely have a higher income as they start to work later in the year.

- To the extent that investment earnings remain after all EAP withdrawals for the children are complete, the excess can be received by the subscriber. However, these amounts are not only taxable, but are subject to an additional 20% tax. Alternatively, up to $50,000 in withdrawals can also be transferred to the RESP subscriber’s RRSP (if sufficient RRSP contribution room is available), thus eliminating the additional 20% tax. An immediate decision is not necessary as the funds can be retained in the RESP until the 36th year after it was opened.

ACTION ITEM: The type, timing, and amount of RESP withdrawals can significantly impact overall levels of taxation. Where an RESP is held for multiple children, greater flexibility exists. Consult a specialist to determine what should be withdrawn, at what time, and by whom.

CPP ENHANCEMENTS: Higher Contributions and Higher Benefits

In 2019, the government commenced a two-part enhancement to the Canada Pension Plan (CPP), with full implementation to be completed in 2025. Phase 1 occurred from 2019-2023; phase 2 will occur from 2024-2025. Overall, the changes will require larger contributions but also will provide larger benefits.

Pre-CPP enhancement

CPP contributions for employees and employers under the pre-enhancement CPP model (referred to as base contributions) were calculated as 4.95% of the employee’s pensionable earnings to a maximum of the year’s maximum pensionable earnings (YMPE; for 2023, $66,600), less the $3,500 basic exemption.

Phase 1

Referred to as the first enhanced CPP contributions, these are calculated as a percentage of the YMPE, less the $3,500 basic exemption, with the contribution rate for employees and employers gradually increasing from 4.95% in 2019 until it reached 5.95% in 2023.

Phase 2

Referred to as second enhanced CPP contributions, the contribution rate for employees and employers will be 4% but will only be applied to earnings above YMPE up to the yearly additional maximum pensionable earnings (YAMPE) ceiling. For 2024, YAMPE will be set at a number 7% higher than YMPE, estimated at $72,400. For subsequent years, YAMPE will be 14% higher, estimated at $79,400 for 2025.

The rates discussed above apply separately to both the employer and employee. Where the individual is self-employed, they are responsible for both the employer and employee contributions.

The payout

The enhanced portion of CPP payouts will only be available to those who contributed since the enhancements were introduced in 2019. Employees that have fully participated under the enhanced contribution regime for sufficient years will receive maximum retirement benefits set at 33% of pensionable earnings, whereas benefits under the pre-enhancement regime would be 25%.

ACTION ITEM: Employers, employees, and self-employed individuals should all be aware that the costs of the CPP will continue to increase as the changes are fully phased in. Individuals should be aware that their take-home pay may be reduced, and employers should budget for these higher costs.

FIRST HOME SAVINGS ACCOUNT (FHSA): A New Investment Tool

The tax-free FHSA was introduced in 2023 to help first-time home buyers save up to $40,000 for a home purchase.

Individuals eligible to open an FHSA must be at least 18 years of age and resident in Canada. The individual must also have not lived in a home that they or their spouse owned jointly or otherwise at any time in the year or the preceding four calendar years.

Contributions to an FHSA are deductible (like an RRSP). Income earned in an FHSA and qualifying withdrawals from an FHSA made to purchase a first home are non-taxable (like a TFSA).

The lifetime limit on contributions is $40,000, subject to an annual contribution limit of $8,000, both of which apply at the individual level. Each spouse (or commonlaw partner) could invest $40,000 and withdraw the full value (including investment income and growth) tax-free to acquire their first home. Individuals can carry forward unused portions of their annual contribution limit up to a maximum of $8,000.

Individuals can also transfer funds from their RRSP to an FHSA tax-free, subject to the $40,000 lifetime and $8,000 annual contribution limits. The maximum participation period for an FHSA ends at the earliest of:

- 15 years after opening an FHSA;

- the end of the year following the year of the individual’s 70th birthday; and

- the end of the year following the year when the individual first makes a qualifying withdrawal from an FHSA.

Any funds remaining in the plan after the maximum participation period could be transferred tax-free into a RRIF or an RRSP without eroding contribution room. Otherwise, the funds will have to be withdrawn on a taxable basis.

Timing of opening an FHSA

A June 28, 2023, Advisor’s Edge article (How to properly plan the opening of an FHSA, Charles-Antoine Gohier) discussed the impact of individuals purchasing homes later in life on FHSA planning.

The article quoted a study from 2020 that estimated that the average age to buy a home in Canada is 36. If an individual opens an account at age 18, the plan must be closed no later than 15 years later, that is, when the individual is 33. If the individual contributes the annual maximum of $8,000 for the first five years to reach the maximum contribution of $40,000, assuming a 4.5% return, the balance of the FHSA would be $74,221 at the end of 15 years. If not used for a home, the individual must either withdraw the balance on a taxable basis or roll the balance into their RRSP on a tax-free basis. While rolling the FHSA into the individual’s RRSP does not erode their RRSP contribution room, no tax-free withdrawal would be possible for subsequent use of the funds to purchase a first home. Up to $35,000 could be withdrawn from the RRSP under the home buyers’ plan, but this would be subject to repayment conditions. Where sufficient funds are available in the RRSP, the home buyers’ plan can be used in conjunction with a tax-free FHSA withdrawal.

Home buyers’ plan (HBP)

In a May 15, 2023, French Technical Interpretation, CRA was asked whether an individual could withdraw $8,000 under the HBP and contribute the funds to a tax-free FHSA, knowing they would purchase a qualifying home the following month.

CRA first noted that the HBP and FHSA can be used for the same home purchase. Provided that the relevant requirements of both plans were complied with, the taxpayer could contribute the HBP withdrawal as a deductible FHSA contribution, then take a qualifying withdrawal from the FHSA in respect of the same home purchase.

This would be an alternative to rolling funds from the RRSP to the FHSA. Using the HBP approach would provide an immediate deduction for the FHSA contribution (a rollover would generate no deduction) but would also require the HBP withdrawal to be repaid to the RRSP in future years to avoid tax. The legislation does not impose any minimum period that contributions must remain in an FHSA before being withdrawn to acquire a home.

Tax-free qualifying withdrawals

A May 23, 2023, Advisor’s Edge article (What are the FHSA qualifying withdrawal rules?, Rudy Mezzetta) discussed the conditions for a qualifying withdrawal.

The taxpayer holding the FHSA must be a resident of Canada at the time of withdrawal and remain so until the qualifying home is acquired.

The taxpayer must also have a written agreement to buy or build a qualifying home before October 1 of the year following the first qualifying withdrawal. Further, they must occupy or intend to occupy the qualifying home as a principal place of residence within one year after buying or building it. The article indicated that CRA had confirmed, in an email, that there is no minimum amount of time that the taxpayer must live in the qualifying home. The article also noted that if the acquisition of the home before October 1 of the following year was frustrated by unforeseen events, the taxpayer may have to provide evidence supporting their intent to occupy the property to avoid the withdrawal being subject to tax.

The individual must also be a first-time home buyer, defined as someone who has not owned or jointly owned their principal place of residence in the current year or any of the previous four years, to make a qualifying tax-free withdrawal. Unlike the requirements for opening an FHSA, home ownership by the individual’s spouse or common-law partner is not considered in the definition of a qualifying withdrawal. The individual may own the qualifying home for up to 30 days prior to the qualifying withdrawal and still be a first-time home buyer.

ACTION: Consider whether opening up and contributing to an FHSA is an option for you or a family member

Prioritizing The Security And Protection Of Our Client’s Assets

Fraudulent activities and scams continue to pose a risk to individuals and organizations alike. As part of our commitment to your financial well-being, we want to ensure that you are aware of these risks and equipped with the knowledge to protect yourself.

The Impact of Fraud and Scams

In Canada, reports to the Canadian Anti-Fraud Centre revealed staggering losses of $530 million in 2022, with a concerning 40% increase compared to the previous year. However, it is important to note that these figures likely represent only a fraction of the total financial losses, as estimates indicate that only 5-10% of fraud cases are reported.

Protect Yourself and Your Investments

Education is vital to staying one step ahead of fraudsters. Therefore, we encourage you to familiarize yourself with the following guidelines to protect your investments:

- Be cautious of investment offers that seem too good to be true, whether from friends, family, social media contacts, or websites.

- Be skeptical when someone insists that you keep an investment opportunity confidential.

- Exercise caution with unsolicited investment opportunities received online or via phone.

- Take your time to evaluate offers and avoid rushing into decisions. Fraudsters often use high-pressure tactics to exploit time constraints.

- Assess the credibility of the information or “hot tips” you receive. Consider the motivations behind those providing the tips and verify the legitimacy of the information.

- Before making investment decisions, verify the registration and background of the person offering the investment. Generally, anyone selling securities or offering investment advice must be registered with their provincial securities regulator.

- When in doubt, ask questions and consult with your dedicated Financial Services Executive (FSE) Advisor or TriCert Portfolio Manager before proceeding.

Our Role in Preventing Fraud

There are many ways we help protect our clients:

- We maintain up-to-date client records, including telephone, email, and mailing address details and Know Your Client (KYC) information. This information enables us to identify any uncharacteristic or uncommon requests.

- We verify the accuracy of requests against the information on file.

- We adhere to strict guidelines regarding the authorization of instructions and the disclosure of information. We request written and signed instructions from clients before sharing confidential information or acting upon requests.

- We exercise caution with requests involving unfamiliar addresses, bank accounts, or third parties. We may contact your Trusted Contact Person (TCP) for clarification if we have any doubts.

- We ensure the secure disposal of unnecessary paperwork containing personal information through shredding.

- We encourage the immediate reporting of suspicious requests or fraudulent activities to your DJB Wealth Management Advisor or TriCert Portfolio Manager.

- Never share sensitive personal account information via email.

Additional Measures for Client Protection

Apart from our internal efforts, we urge you to take the following steps to safeguard yourself against fraud:

- Create strong and unique passwords for your accounts, changing them periodically. Whenever possible, enable two-factor authentication for added security.

- Exercise caution when clicking links or opening attachments, especially from unfamiliar sources.

- Be mindful when using public Wi-Fi networks, which may pose security risks. Assume that your online activities can be monitored.

- In case of suspicious phone calls, immediately terminate the call without sharing any personal or financial information. If you need more clarification about the legitimacy of the phone call, contact the alleged source directly using a reliable phone number from a trusted source.

- Never grant strangers remote access to your devices or computers, as this can be exploited to obtain personal financial information.

What to Do if You Become a Victim of Fraud

If you believe you have fallen victim to fraud, please remember that it can happen to anyone, and you should not feel ashamed. Here are the initial steps to take:

- Document all relevant information regarding the incident, as it may be required for investigations.

- Notify your DJB Wealth Management Advisor, TriCert Portfolio Manager and/or financial institutions.

- Change your passwords with us and other financial institutions or service providers.

- Request warnings be placed on your accounts to ensure additional precautions are taken when accepting or disclosing information.

- Consider reporting the fraud to Equifax and TransUnion. If you suspect mail redirection, please get in touch with Canada Post.

- Report the incident with the Canadian Anti-Fraud Centre. They can be reached toll-free at 1-888-495-8501 or through the Fraud Reporting System.

Test Your Knowledge

To test your knowledge and enhance your awareness of fraud prevention, visit this Government of Canada resource.

We remain committed to your financial security and well-being. If you have any questions or concerns regarding fraud prevention or any other matter, please don’t hesitate to contact your dedicated DJB Wealth Management Advisor or TriCert Portfolio Manager.

![]()

Charitable Gifting of Securities

According to Statistics Canada, Canadians donate $10.6 billion annually to charitable and non-profit organizations for altruistic reasons. While most of this is in the form of cash donations from after-tax dollars, there is also the option for gifting using investment securities. This could be done by those who do not have the cash resources for charitable gifting but who may have investment assets that could be used instead of an outright cash gift, or for those who want to donate and take some tax benefit for themselves at the same time. It is therefore important to understand these additional tax benefits available when you have qualifying charitable donations of securities to include on your tax return.

The following provides some helpful information if you are considering this strategy.

Charitable Giving Using Investment Securities

Most charitable organizations accept investment securities as gifts or donations instead of cash. These are referred to as donations in-kind and are eligible for the donation tax credit equal to the market value of the investment at the time it is transferred to the charitable organization.

When gifting an investment security to a registered charitable organization, Canada Revenue Agency (CRA)does not require the taxpayer to recognize any taxable gains associated with the donated investment securities.

Using an example to illustrate, let’s say an individual wants to donate $10,000 to a registered charity. In order to fund that donation, this individual needs to sell $10,000 worth of stock which they originally purchased for $6,000. When the donor files their tax return, they will need to include the $4,000 capital gain income ($10,000 – $6,000), of which 50%, or $2,000, is taxable. If this individual has a marginal tax rate of 40%, the act of selling those shares to fund their donation added $800 to their tax bill ($2,000 x 40%).

Alternatively, if the donor in the example above had gifted the shares to the charity, they would not have had to recognize the capital gain and saved $800 in tax while receiving a tax receipt for the $10,000 donation. So, if you are thinking of donating, check your investments and consider making the donation by a transfer of securities – you may be able to save on tax and make a larger charitable contribution as a result. And most importantly, you will be contributing to a worthy cause.

NOTE: These are general figures for the purposes of illustration. We recommend you seek appropriate professional advice before deciding on your charitable gifts.

Psychology of Selling Your Business

Whether you’re an established business proprietor, a generational business owner, or an entrepreneur, you’ve put your heart and soul into building your company. Still, there comes a time when you need to move on, and that’s where selling comes in. However, it’s more than finding the right buyer and negotiating the best price or contract terms. Many owners, like you, find themselves struggling with a deep-seated reluctance to sell, which can be hard to understand and even harder to overcome.

You may have invested so much time and energy into your business that it’s become a part of you. Or there are family issues that are holding you back. Whatever the reason, it’s essential to recognize that this reluctance is not uncommon, and it’s perfectly normal to feel this way.

You may find yourself delaying the acceptance of a fair offer, stalling the process, declining, or otherwise sabotaging the deal without really understanding why. You may think it just didn’t “feel right”, the buyer wasn’t the right fit, or you convince yourself you’re not ready. Perhaps it is one of these reasons, but often this is not the case.

The psychology of selling your business

Selling a business that has been painstakingly created, nurtured, and struggled with, and one that is ultimately successful, is akin to a child leaving home to take on the world for themselves. For owners like you, a business can be like having a child. Whether you’ve conceived the business from an idea, inherited the family business, or purchased an established enterprise, you’ve put your blood, sweat, and tears into your business to make it successful.

Like new parents, you can often feel nervous, unprepared, and overwhelmed, having never done this before. Regardless, you push through as the reward and satisfaction far outweigh the fear; the effort is fulfilling and long-lasting. Over the years, you’ve spent many hours cultivating and nurturing the business, celebrating its successes, and watching it grow into a successful, independent, self-reliant enterprise that is ultimately valuable to the world.

You and your business struggled together, overcame obstacles in the face of adversity, stumbled, got back up, and learned and grew through it all. Like a baby, you initially carried the business when it could not carry itself. Over time, your business grew and found its legs and rhythm. As your business matured, it became important to others – clients, staff, suppliers, and, most importantly, you. Like a child, the business gained independence over time and needed you less and less, becoming an entity unto itself. You no longer manage every aspect of the enterprise, coddle it, and protect it. Your business has become a thriving entity that can stand on its own.

Letting go of what you or your family created, nurtured, and grew is often very difficult. Like a child, you are proud of what it has become but still worry about what might happen if you let it go. Will it be okay without you? Will it be damaged if you are not there to protect it? Will it even survive if you are not guiding it in the future?

With business, as with children, you reach the point where you have done everything you can to prepare it for the world, and you must let go. Let it move on. Let it continue its evolution, whatever that may be.

Considering a different perspective about the sale of your business and understanding the emotions you may be experiencing often helps you conquer the reluctance of finalizing the sale. Selling is a very difficult time for many business owners, which could result in a lost opportunity to monetize your lifelong achievements if you can’t overcome this obstacle.

How we can help

Work with your trusted accounting and financial advisors under our TriCert™ integrated approach. We specialize in owner-managed businesses to help you overcome many psychological hurdles of selling your business.

Leveraging the experience of accountants and tax specialists, and integrating these advisory services with your financial planner, can give you the peace of mind and the confidence to work through one of the most significant events in your lifetime with a strong team supporting you every step of the way.

![]()

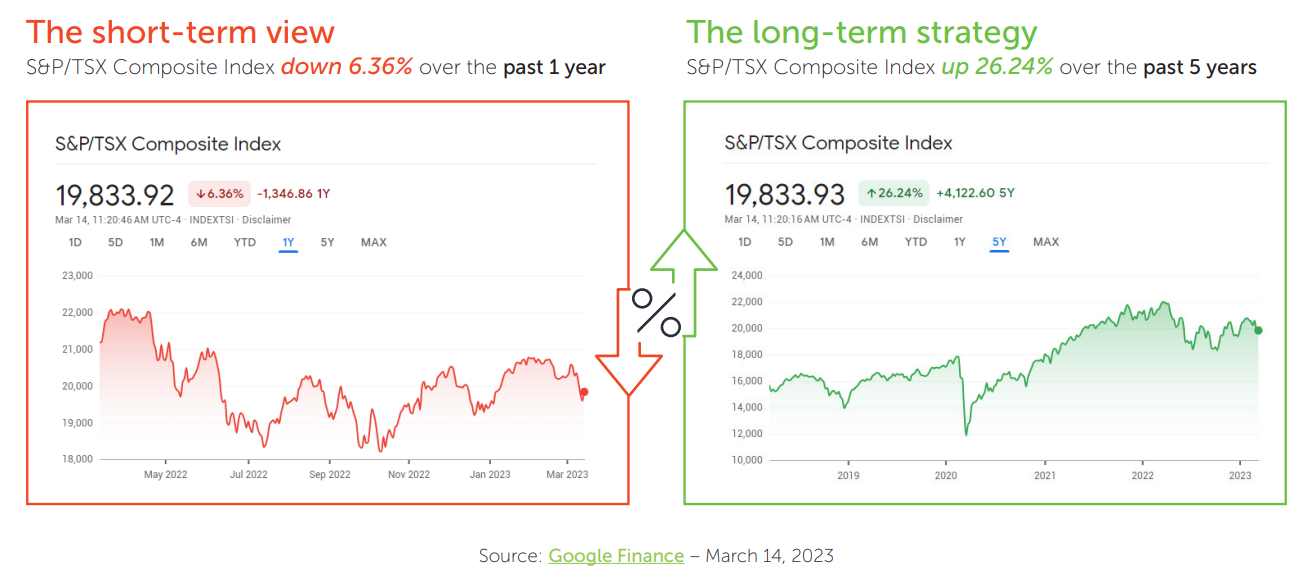

Staying Calm When Markets are Volatile

Why Avoiding Short-Term Performance Figures Can be a Sound Strategy

In times of economic turbulence, it’s normal to feel apprehensive when you’re about to read your portfolio’s performance. And, of course, seeing the fluctuating short-term results doesn’t help. It is more important to keep your sights on the bigger picture and stay focused on your long-term investment strategy and performance. By doing so, you can navigate the choppy waters of the current economic climate more confidently and ultimately achieve your financial goals.

Typically, volatility is a short-term issue; in the long run, your long-term investment plan and confidence in your investment holdings matter. Therefore, avoiding short-term “noise” can be a good strategy. While performance is undoubtedly crucial, it should be evaluated in years, not months.

For example, take a look at it in graph terms:

Strategies for navigating market volatility

The performance figures can be an unpleasant surprise, depending on the period you are looking at or the duration being reported on your account statements.

Consider:

- Evaluating the quality and long-term sustainability of your investments with your portfolio manager. It’s likely that your holdings are still reasonable, and no drastic changes are necessary. You may come across opportunities to refine your portfolio, but try to refrain from making significant “panic changes” that could lead to missing out on future market recoveries.

- Updating or creating a financial plan. It’s crucial to take this step during market downturns as it can

provide reassurance that your long-term financial goals are still achievable. Our experience has shown that personal financial plans often remain on track despite market downturns. Take advantage of this opportunity to update your plan and gain some much-needed reassurance. - Triggering a capital loss strategically if you have non-registered accounts. This can help offset a realized capital gain if you plan to sell an asset, or if you need cash or want to diversify your holdings.

- Lowering the risk profile of your account permanently only if you cannot tolerate market

volatility anymore. It may involve selling some holdings at a less-than-ideal time, but taking a hit now could be easier for you in the future. However, this should be considered a final, one-way option.

Reframe your perspective

Imagine thinking about your investment portfolio as if it were your own home. This relatable comparison can help you weather market downturns with greater ease.

Unlike your monthly investment statement, you don’t receive regular updates on your home’s value nor see real estate index numbers fluctuating in real-time. This lack of daily stress means that when the value of your home drops, you don’t immediately consider selling it. After all, your home is a long-term investment and a significant part of your net worth.

Similarly, selling off your stocks doesn’t make sense just because the market is down. Likewise, jumping

out of the market and buying back once values have risen is not a sound strategy. Instead, stay the course

and trust in your long-term investment plan.

Bottom line

We will always have periods of volatility. It’s important to keep calm and avoid knee-jerk reactions that may jeopardize your long-term plan. Review your portfolio and strategies with your Accountant, Financial Planner, and Portfolio Manager, and gain the confidence you need to stay the course.

![]()